ad valorem stamp duty malaysia

Stamp duty would be charged according to 1 on RM100000 of value and 2 on RM400000 of value. 100 loan is possible but uncommon for most people.

C2 Stamp Duty The Malaysian Institute Of Certified Public

Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

. The stamp duty is 05 of loan amount. The rationale for imposing the ad valorem rate of charge of 01 on a sub-service agreement under Paragraph 2 2 b of the 2010 Order is that a service agreement relating to an undertaking awarded by a Ruler of a State or the Government of Malaysia or of any State or local authority is exempted from stamp duty. Subsequent levels Up to RM50.

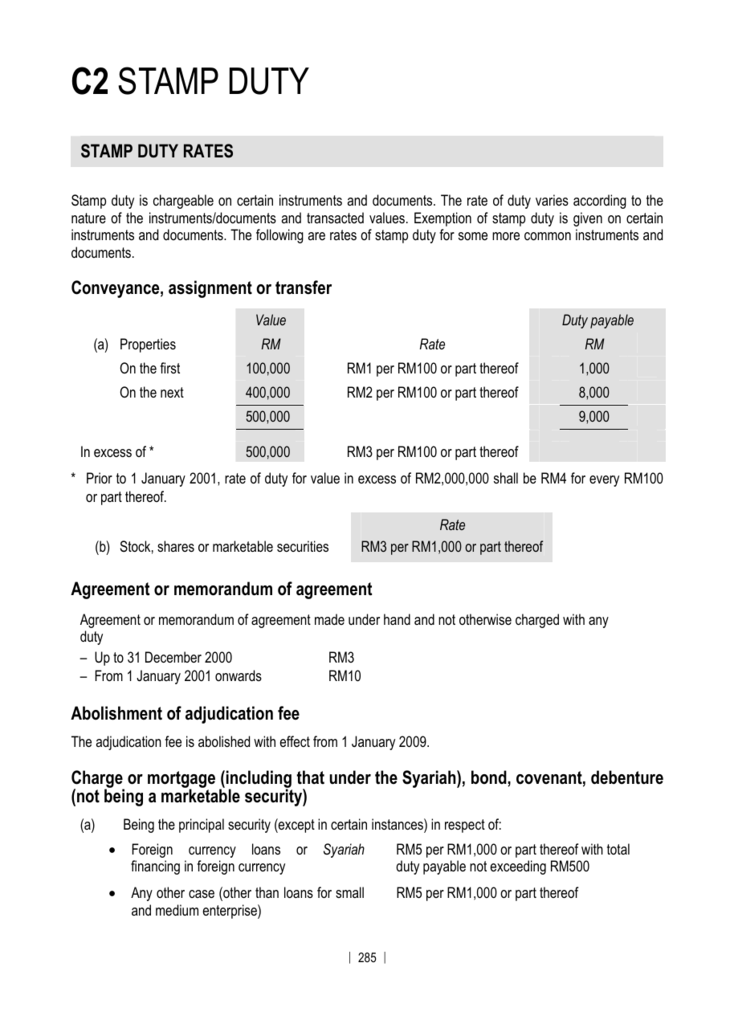

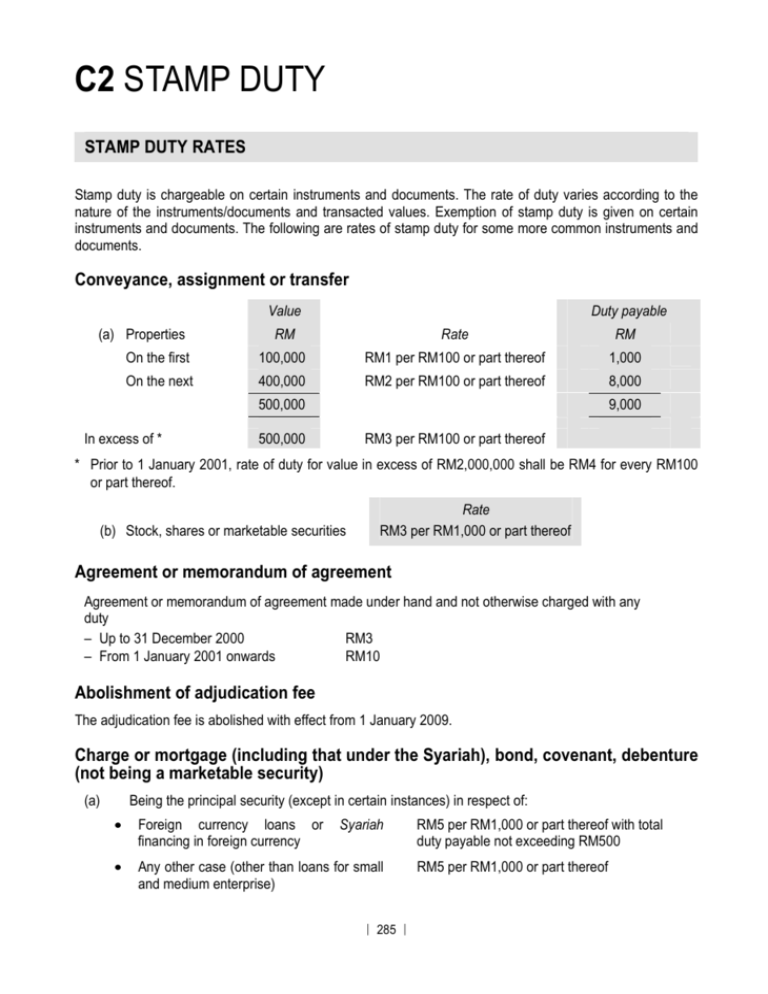

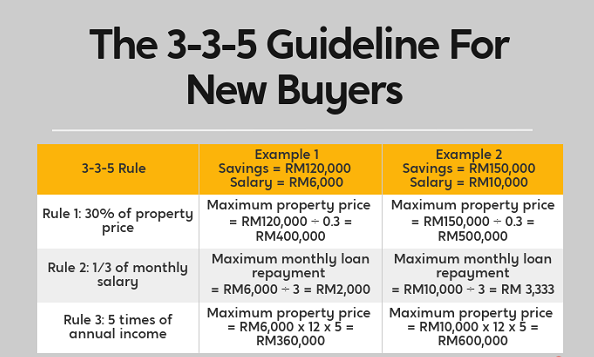

For the first RM100000 1 From RM100001 to RM500000 2 From RM500001 to RM1mio 3 The subsequent amount is 4 Even though everyone required to pay Property Stamp Duty in Malaysia but there is an exemption of paying stamp duty for a first-time house buyer. Malaysia imposes stamp duty on chargeable instruments executed on certain transactions. Ad-valorem stamp duty is assessed based on the consideration sum as stated in the instrument of transfer or the market value of the property as at the date of Sale and Purchase Agreement or Instrument of Transfer.

Pengecualian apa-apa surat cara yang dikenakan duti ad valorem bagi pindah milik hartanah yang digunakan bagi maksud menjalankan suatu projek pelancongan yang layak dikecualikan daripada duti setem. What this basically means is stamp duty is applicable at a fixed tier for the instrument of transfer Fixed Duties AND on a variable cost depending on the value on the loan agreement Ad Valorem Duties. The Order provides that instruments of service agreements Note that are chargeable under Item 221a First Schedule of the SA will be subject to stamp duty at a rate of 01 ie the stamp duty chargeable in excess of 01 is remitted.

The ad-valorem stamp duty is variable cost payable on the Memorandum of Transfer or the Deed of Assignment by way of Transfer will be calculated based on either the purchase price of the Property or the market value of the Property whichever is higher whereas the nominal stamp duty are charged at a set price of RM1000 on every copy of the document. Ad Valorem Duty is the rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or the market value of the property. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

The instrument of service agreement is to be executed by. The increase in stamp duty under item 27aii of the Stamp Act 1949 was one of the measures announced during the 2020 Malaysian Budget. All service agreement one tier Ad valorem rate of 01.

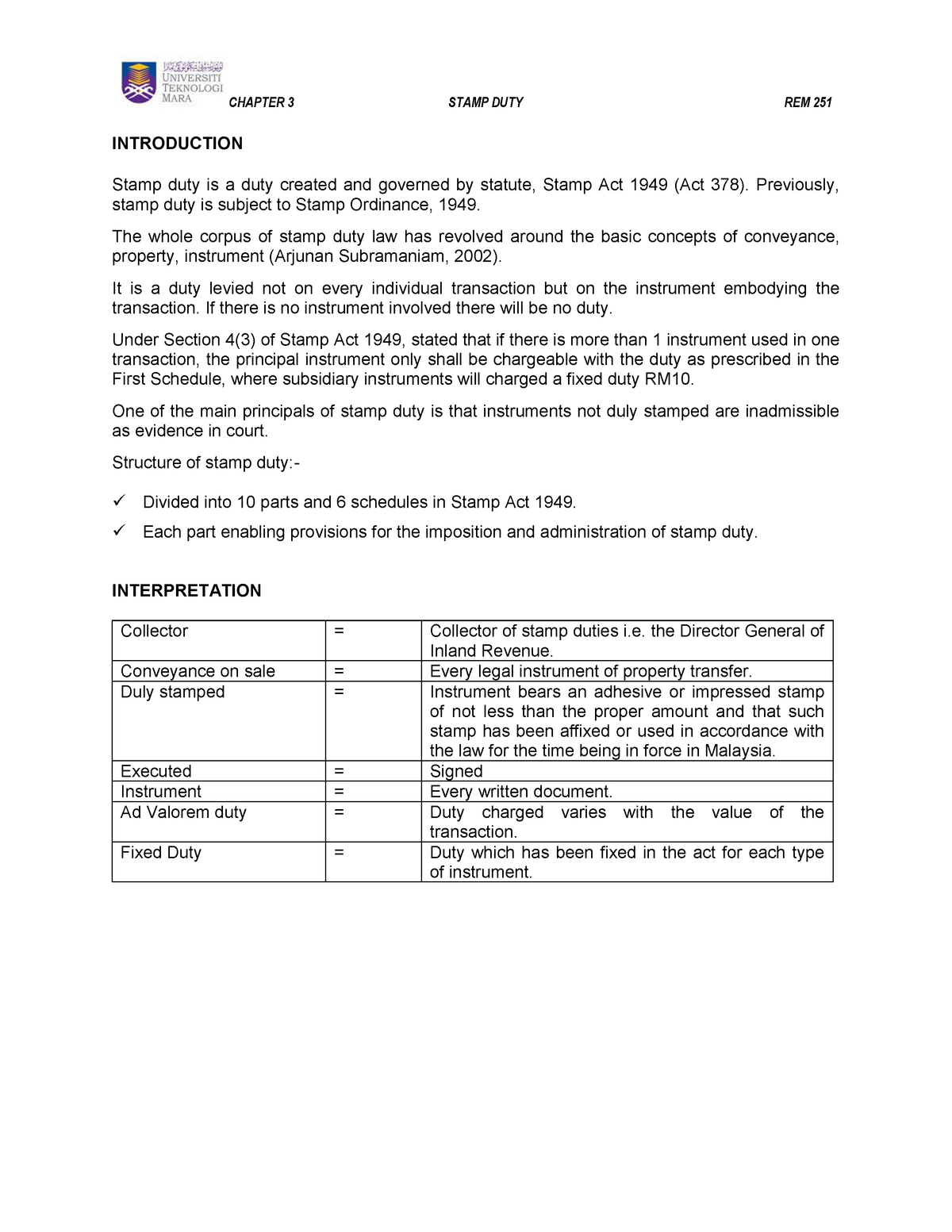

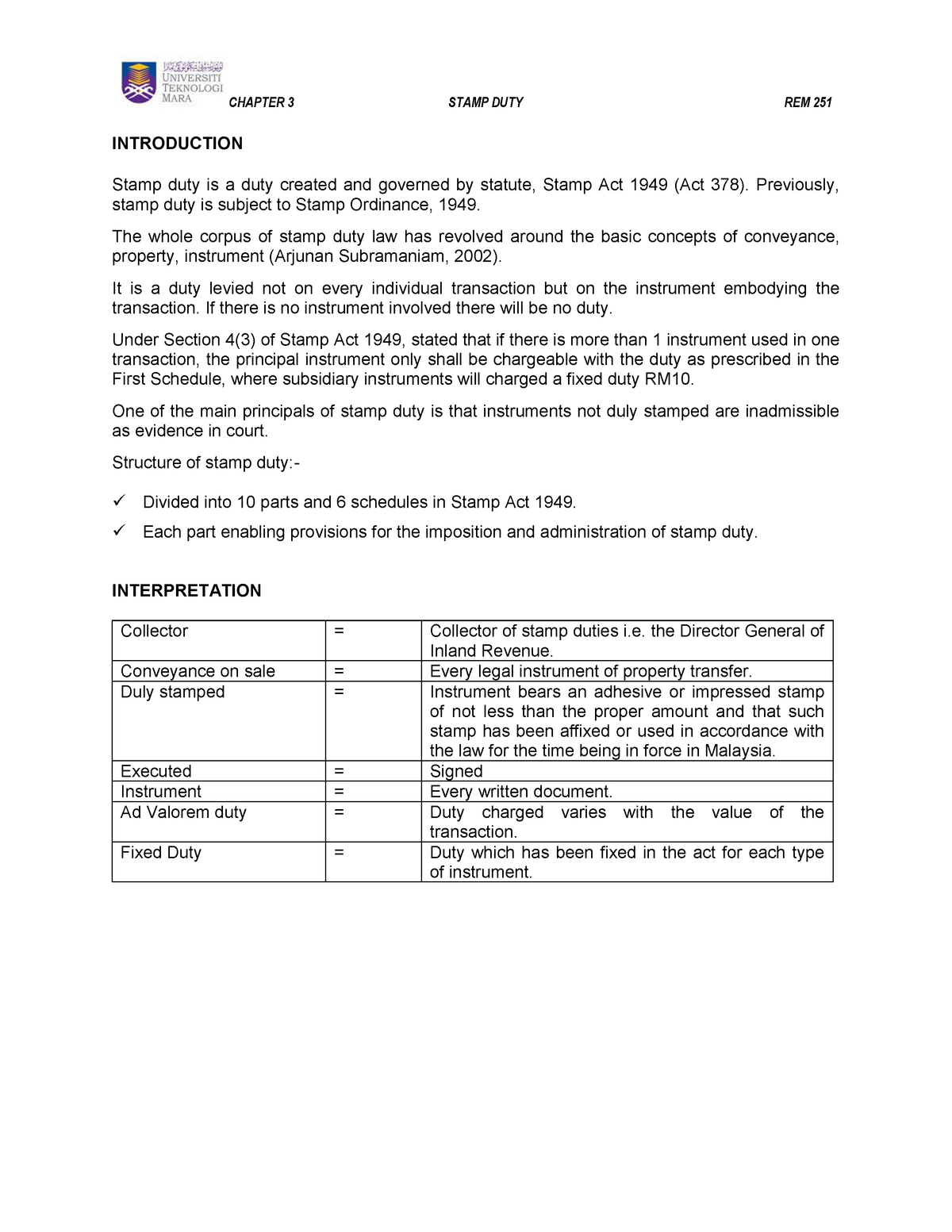

If the shares are transferred between associated companies. There are two types of duty Ad Valorem Duty and Fixed Duty. The assessment and collection of stamp duties is governed by the Stamp Act 1949.

Between private entity and service providers First level. Fixed Duties Fixed charges are RM10 per unit including stamps policies and stamps for every copy. Calculate now and get free quotation.

Tas surat cara pindah milik harta di bawah Pengecualian di bawah subperenggan 1 hendaklah terpakai bagi surat cara yang disebut dalam subperenggan itu yang disempurnakan. According to Clause 27 of the Bill the above-referred amendment will come into operation on 1 January 2020. Ad Valorem Duties Stamp duty based on the value of the transaction on the legal documents including the Memorandum of Transfer Deed of Assignment the equity of the listed company lease loan contract and legal documents.

Presently the maximum amount of stamp duty payable under item 27aii is RM500. Stamp duty based on loan agreement. So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 as 10 of the property price will be for the down payment which you would need to fork out yourself.

The ad valorem rates are 5 or 10 depending on the class of goods. However this exemption is limited for entry level homebuyers for purchases between 1 Jan 2017 and 31 December 2018. Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement.

So what will the stamp duty be. 85 of RM80 mil RM68 mil RM68mil 05 RM340000 Sale and Purchase Agreement Legal Fees When it comes to commercial loans different banks have different criteria for assessment. 1tawaran ini hanya sah untuk rakyat malaysia bagi jualan yang dimuktamadkan antara januari sehingga jun 2019 untuk projek perumahan yang diberikan diskaun sekurang-kurangnya 10 dan disahkan oleh rehda.

Thus based on the RM80 mil factory above say you can get up to 85 loan. The ad valorem duty for the principal instrument of a loan is calculated at RM5 for each RM1000 or part thereof. RM1000 stamp duty owed on the first RM100000 value 1 x RM100000.

There are two types of stamp duties which are ad valorem duty and fixed duty. The transfer of shares will attract stamp duty at the rate of 03 on the consideration paid or market value of the shares whichever is the higher. Stamp duty is a tax based on specific tiers with its own percentage for each level.

Announcement was made by the Prime Minister who also acts as Minister of Finance during the said budget that 100 waiver of stamp duty is to be imposed for houses valued up to RM30000000 from the current waiver of 50. The Property Stamp Duty scale is as follow. Nominal stamp duty is a fixed duty being imposed regardless the consideration sum or market value.

For example if the loan is RM400000 the stamp duty payable is calculated as follows RM5 x RM400000 RM1000 RM2000 b When a document is to be stamped. The tiers are as. Service tax Service tax is a consumption tax levied and charged on any taxable services provided in Malaysia by a registered person in carrying on ones business.

2pengecualian duti setem ke atas surat cara pindah milik bagi pembelian rumah kediaman yang bernilai melebihi rm300000. Why do we need to stamp agreement in Malaysia. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

A Non-government contract ie. Ad valorem rate of 01. The rate of service tax is 6.

Stamp Duty On Instrument of Transfer.

Stamp Duty Imposed For Transfer Of Properties In Malaysia By Tyh Co

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

Changes Proposed To Stamp Act In Malaysia Conventus Law

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Stamp Duty And Contracts Yee Partners

Chapter 3 Estate Management Rem251 Introduction Stamp Duty Is A Duty Created And Governed By Studocu

Stamp Duty Valuation And Property Management Department Portal

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

C2 Stamp Duty The Malaysian Institute Of Certified Public

Stamp Duty In Malaysia Everything You Need To Know

Ad Valorem Stamp Duty Damian S L Yeo L C Goh

Razak Lim Co Ad Valorem Stamp Duty Or Rm10 00 Facebook

Revenue Stamps Of New Zealand Wikiwand

Mof Confirms Higher Rm1 000 Cap For Stamp Duty On Share Purchases As Per The Edge Report The Edge Markets

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Comments

Post a Comment